Shrunken margins despite falling freight prices, and what that means for forwarders.

Volatility is changing the way shippers are approaching business. In this post, using insights collected from surveying over 1,000 importers and exporters, we explore how shippers have adapted to combat this volatility, what keeps them awake at night, and how forwarders should change the way they work with SMBs.

Volatility and falling freight prices: Key context on market conditions

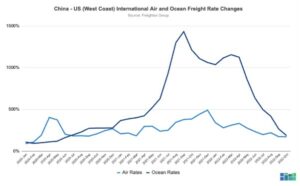

Chief among the contributors to pandemic-era inflation are extremely elevated logistics costs. Over the last few months, though, ocean freight prices have started to come down, as volumes of imported containers to the US fell by more than 8% in September compared to August, with October volumes expected to be about 10% lower than last year.

Freightos Baltic Index data show that rates to ship a forty-foot container from Asia to the US West Coast have come down by over 80% since the end of April, while prices to the East Coast have fallen by almost two-thirds.

A big driver in these falling logistics costs is the drop in overheated consumer spending, which in turn was responsible for increased sales among many importers over the last two years.

Freightos Group survey: Three key takeaways

A recent Freightos Group survey of over 1,000 SMBs using the freightos.com marketplace for international freight reflected the impact of inflated logistics costs on small and medium-sized businesses alongside the mixed sentiment regarding demand as we move into the holiday season.

Despite two-thirds still experiencing stable or stronger sales compared to 2019, and the same share increasing their prices to pass on some of their elevated logistics costs, 87% of importers say their bottom lines were hurt by spiking freight costs during the pandemic.

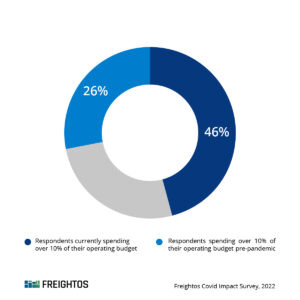

Even when raising their prices, the increase in sales did not result in higher profitability, as many also had to decrease their margins to accommodate some of the elevated logistics costs. In fact, nearly half of respondents (46%) report spending more than 10% of their operating budget on logistics costs, compared to only 26% who spent that much on logistics before the pandemic.

Takeaway #1: Shippers will doubtless be looking for where logistics spend reductions can be made. This may be in the form of reduced costs or take the shape of faster new product sourcing, which is more of an option than before, given the current market slack.

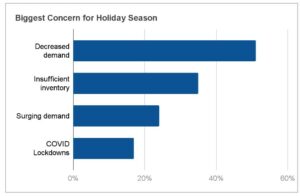

Falling logistics costs could give some relief to SMB importers, but most (51%) are now concerned with potentially falling demand heading into the holidays. This, together with rising inventories (and inventory costs!), may pose new challenges, thereby offsetting any benefits gained from the currently falling freight prices.

Takeaway #2: Shippers are likely to shift their efforts toward sourcing logistics providers able to minimize the consequences of increasing inventories and their costs. This also generates the corollary of a more competitive market for forwarders, since their key concern must now also shift from handling inventory for customers to vying for customers in the first place.

In contrast, about a third of respondents are concerned that supply chain delays will leave them without enough inventory, implying that many businesses are still optimistic about demand in Q4.

Takeaway #3: Some companies have admittedly been burnt by large peak season inventory build ups over the summer. This data nevertheless indicates that shippers are looking to plan ahead for their 2023 stock at these low prices, to ensure the procurement of sufficient inventory in time. This is likely due to a drop in respondents’ trust of the logistics industry (nearly 60% report not trusting the logistics industry entirely to move shipments from point A to point B), meaning they are looking to mitigate the effects of any potential supply and logistics disruptions.

Sea-change necessary for forwarders? Top 3 recommendations.

Here are our top 3 recommendations for how forwarders can improve the effectivity of their operations, based on the modified shipper behavior-patterns seen in this most recent Freightos Group survey.

1. In light of the potential drop in consumer demand over the holiday season, shippers are likely to shift their focus toward customer acquisition and retention. One way they can keep or convert customers is with lower costs. Logistics providers who can, at least for the time being, reduce their margins may be able to attract long-term and cement a loyal customer base.

2. Forwarders can also differentiate themselves by providing insights on inventory management. Forward-looking guidance on potential upcoming disrupters like the Chinese New Year or labor disruptions at ports around the world is of particular value, since such insights help SMBs to reduce the costs passed along to consumers, ultimately encouraging their retention.

3. Respondents’ lingering resentment about the ongoing lack of supply chain dependability, particularly among smaller businesses, means that active transparency with customers or prospects regarding contingency planning could take center-stage as a determining factor for how they select logistics providers. Forwarders would do well to adopt proactive data-driven information sharing policies ahead of 2023.

Forwarders, looking for insights on the current state of freight?

Subscribe to WebCargo’s DAC monthly newsletter here to stay updated on air cargo demand trends, available air cargo capacity, airline acceptance rates, WebCargo monthly updates and more!

The bottom line for increasing a forwarder’s bottom line

The results of this latest Freightos Group survey [link to survey] have shown that in an increasingly competitive landscape, shippers are not only looking for spend reduction on logistics costs, but also for data on supply-chain disruptions and contingency planning to make decisions that mitigate the effects of volatile market conditions. Meeting these expectations is therefore a necessity for forwarders (and shippers!) looking to gain an edge in customer acquisition and retention, translating into added value for forwarders and shippers alike.