Freight Market Update – May

Check out this month’s air cargo trends and insights presented by Judah Levine.

Webinar

In this month’s Freightos Market Update, Judah Levine, Head of Research at Freightos, is joined by Jonathan Gold, VP of Supply Chain and Customs Policy at the National Retail Federation, to unpack the latest freight market shifts and their potential impact on retailers, importers, and global trade.

From tariff whiplash to early peak season signals and air cargo realignments, here’s what’s shaping global freight in May.

Highlights from This Month’s Update:

- Tariffs, Trade Talks & Demand Whiplash.

Global and reciprocal tariffs remain in limbo –but not without consequences. Even with a temporary China-US de-escalation, base tariffs still sit at 30%+ for Chinese goods, reshaping sourcing strategies and sparking wide demand swings. - Front Loading & Peak Season Pressure. Ocean import volumes surged in April but are set to dip in May, exposing a split trend: sharp drops from China paired with gains from Southeast Asia. With tariff deadlines looming in July and August, the big question is – has peak season already begun?

- Container Rates & Capacity Disruptions. Transpacific blank sailings, rebounding demand, and aggressive GRIs could push container rates back toward 2023 peak season highs. But new alliance structures and added fleet capacity are still holding down rate inflation – so far.

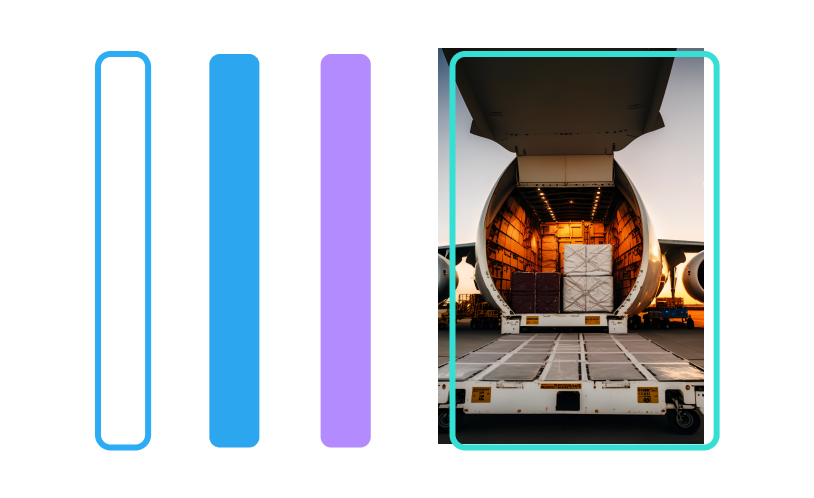

- Air Cargo’s E-Commerce Shift. The cancellation of China’s de minimis exemption is driving eCommerce platforms away from air freight and into ocean and warehousing. While B2C demand is slipping, freighter capacity is shifting lanes – causing rate volatility and new trade dynamics across markets.