Improving Airline Visibility Into Cargo Bookings

In June 2023, WebCargo’s Airline Dashboard that provides data and real-time actionability for airlines on WebCargo was released from beta.

This new tool, which drives air cargo bookings across dozens of airlines, provides airlines with visibility to nearly real-time industry data, including the Freightos Air Index as well as airline-specific lane-level insights, like sophisticated data on customer price sensitivity, how soon before departure customers book or cancel, data on origins and destinations, and other market trends. As Freightos CEO, Zvi Schreiber, shared at WCS 2023, airlines need to be empowered with the tools to also react based on air cargo market conditions, which is why the dashboard extends into enabling airlines to both read the market and adapt accordingly.

In the following interview with Sergio Puig Ortuño – Product Manager at WebCargo, and one of the developers of the Dashboard – we explore what the Dashboard offers, how it came about, and how both carriers and forwarders can benefit from the new visibility and agility it represents.

You can learn more about the Airline Dashboard here or read about it in publications like Air Cargo Week or Air Cargo News.

What is the WebCargo Airline Dashboard and how did it come about?

Since the launch of eBooking on WebCargo, airlines have frequently approached us, asking us to export reports on different areas of their sales performance or to make certain configuration adjustments to how they were selling on the platform. So we recognized the opportunity in terms of speed and efficiency in letting them view their performance data and customize their offering themselves – that is the Airline Dashboard.

Leveraging the digitalization underpinning air cargo eBookings and the data it makes available, the Airline Dashboard gives carriers visibility into their actual performance selling online, unlocking a level of real-time analytics not possible before, and allowing airlines to be better informed about their customers and make better decisions. It also lets carriers customize configurations like load restrictions or embargoes, or easily add lanes improving their agility and responsiveness to the market.

Airline? Looking to unlock Digital Air Cargo sales?

Learn more

What KPIs can carriers track on the Dashboard, and how are these being leveraged?

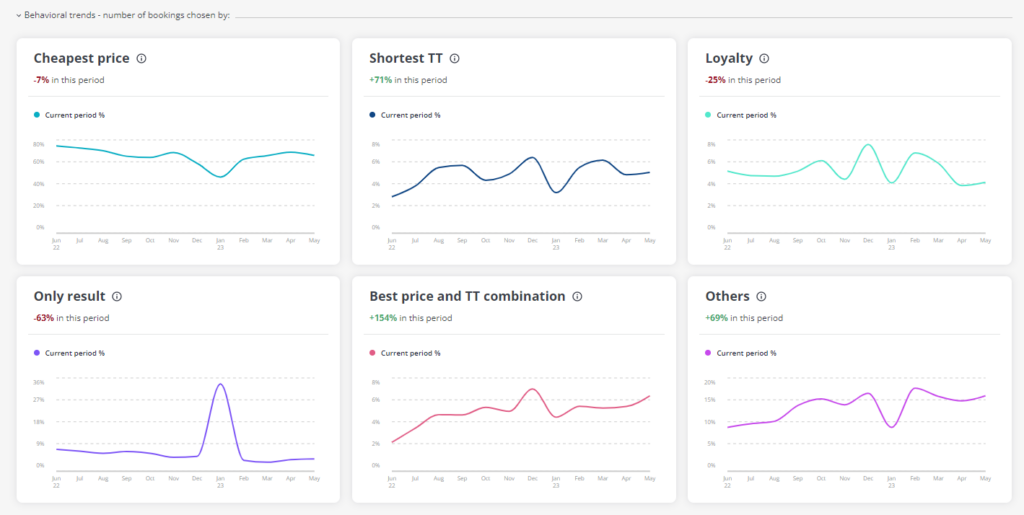

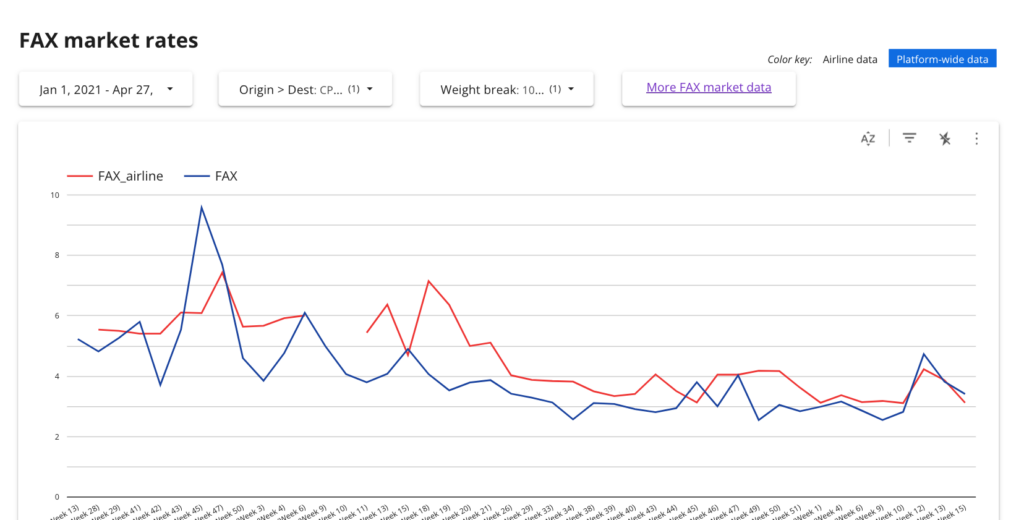

The dashboard lets carriers track KPIs like the number of bookings, conversion rates, cancellation rates, and search to book ratios at given price points. They can also compare their prices to the median price per lane offered across carriers on the platform or to benchmarks from the Freightos Air Index, or view platform-level conversion rates relative to the range of prices offered by carriers, and determine where they are relative to the market and their performance at that price.

The addition of this performance and air cargo market intelligence to WebCargo’s eBooking platform, for the first time, creates essentially a one-stop shop where airlines can measure demand in real-time, get sales insights across regions with little lag, and make decisions and adjust their offerings accordingly.

Airlines are using this visibility for decisions ranging from implementing cancellation policies and adding new routes or services where demand or rates are strong, to adjusting pricing in response to conversion rates or competitiveness relative to the market price.

The Dashboard is for airlines, but what impact do you think it can have for forwarders booking on WebCargo?

I think it can increase revenue for carriers where they find they are priced below the market, improve utilization when that’s a business priority, or identify where they are losing sales by being too expensive. But the flip side is positive impacts for forwarders in terms of more competitive pricing on some lanes, better rate visibility, and in terms of enabling carriers to easily add more lanes and services to the platform, increasing the options for forwarders too.