WCS Retrospective: The untapped airline profits of Digital Air Cargo

This is a summary of the talk I gave in Istanbul to the air cargo executives who gathered from around the world for the WCS event in Istanbul.

It’s 2023, and over the last few years, airlines have provided digital air cargo offerings with impressively rapid adoption. Carriers representing over 50% of air cargo capacity are now digitized – a staggering 16x surge since 2018. Digital offerings provide both carriers and forwarders with increased revenue, lower operational costs, better business intelligence for more agile pricing, and a superior customer experience.

But while airlines have started to provide eBookings in rapid succession, most haven’t changed their pricing models to take advantage nearly as quickly, leaving money – and capacity – on the table. Why?

The answer lies in the past, present, and future of eBookings.

The Past: The digital revolution and explosive rise in eBookings

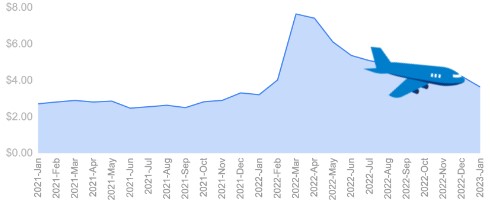

We’ve been through a particularly volatile period for the air cargo market due to Pandemic-induced rushes on PPE, Corona restrictions impacting schedules, absence of bellyhold capacity, and many teams working remotely.

In order to cope with a daily landscape shift, caused by economic and geopolitical events, carriers accelerated their shift to digital tools (which is also the key stepping stone to enabling forwarder digital transformation). Airlines realized that the only way to serve customers wherever, whenever they are needed, was by giving real-time access to carrier schedules, prices and capacity for real-time eBooking.

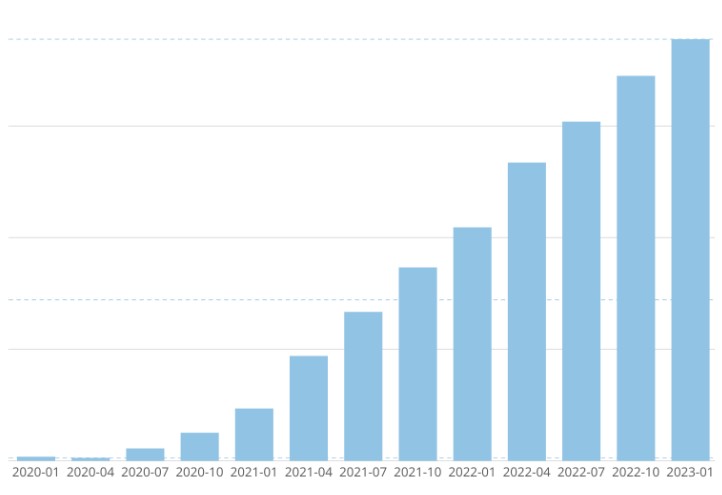

Carriers introduced instant air cargo rate search and eBooking, and the industry exceeded expectations with a robust adoption rate. Just years after the first eBooking, 15-25% of all air cargo bookings are now being made on third party platforms like WebCargo in 5+ West-European markets. And other regions are following.

In fact, a recent survey shows that nearly half of the top 25 air cargo carriers enable instant freight quotes on third party platforms, with over 45% offering eBookings and instant confirmation. Such digital offerings enable airlines to reach new markets and segments, providing customers with immediate visibility into that carrier’s lanes and services they may otherwise not have been aware of.

[optin-monster slug=”xu9oodkr3wc2yvmdlszy” followrules=”true”]

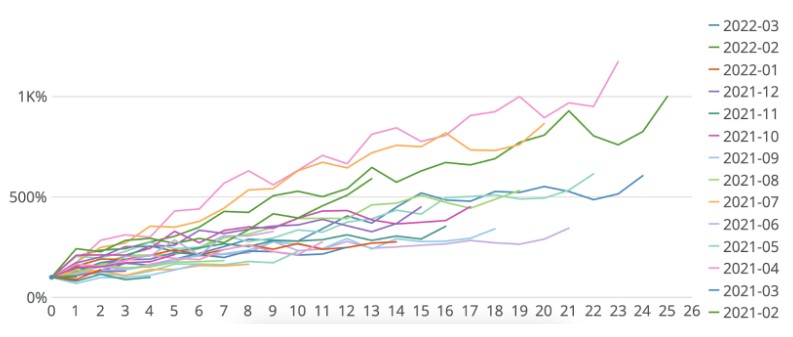

Forwarders are embracing digital efficiency too, with a consistent rise in forwarder eBooking adoption. With the massive spike in online carrier cargo capacity and visibility, forwarders are reaping the rewards of discovering and comparing capacity and rates from leading global carriers in real-time online.

In the following graph each line follows a ‘cohort’ of forwarders who first used eBooking in a given calendar month. 12 months later not only has there been no attrition of the cohort, but in fact their volume of air cargo eBookings has grown by hundreds of percent.

eBooking’s past in four words: Faster than expected adoption.

Airlines are using eBooking to maximize their utilization and yield with a lower cost of sale. Osman Ustabas, Manager, Business Development and Innovation at Turkish Cargo summarizes the impact brought by the shift to digital offerings:

“We estimate that eBooking has reduced our time required for bookings by 90%. The speed of eBooking has not only given our customers a fast, easy way to find, compare and book our real-time rates and capacity, but also reduced our errors and costs, freeing our sales teams to focus on value-added tasks, which further improves the customer experience.”

Forwarders are also seeing business benefits. According to Charles Marrale, CEO of ExFreight:

“We can show customers accurate information with regard to pricing, available flights, space …one API connection… Digitization has greatly improved the efficiency of the operations team. They can now do more with less.”

But…

Untold Profits Still Await Airlines: The secret lies in the Present state of eBookings.

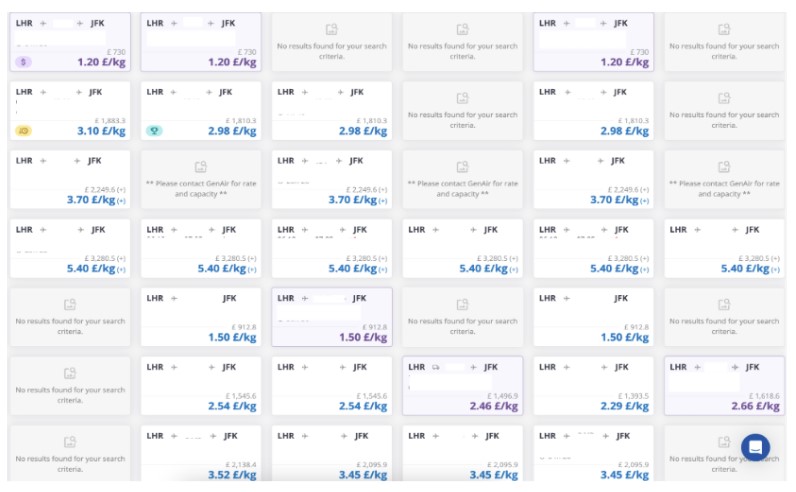

Granted, many air cargo bookings are now not made how they used to be in days gone by, with carriers manually sending out prices to forwarders. Instead, third-party platforms like WebCargo are querying them in real-time, and allowing bookings to be placed in real-time too, via API connection. Nonetheless, quoting and booking is not truly digital yet, and two problems still persist:

- Although third-party platforms like WebCargo are querying carriers for their rates and capacity in real-time, tens of thousands of times a day, in almost 90% of cases, carriers are sending back static rates. In most cases behind the real-time API connection there is still an Excel spreadsheet. This means that many of the carrier rates offered are actually as static as ever.

- The rates offered by airlines are often inappropriate. A quick search on the WebCargo matrix for rates from LHR to JFK, reveals that one airline quotes £5.40/Kg while another quotes £1.20/Kg for the exact same service. £5.40 is way above market, and nobody will book that even if they like the carrier’s service. 1.20 is unnecessarily cheap, a full 25% below the next cheapest airline.

The significance of this misaligned pricing cannot be overstated. Thousands of times a day some carriers are pricing themselves out of the market and losing volume while others are pricing way below the market and leaving money on the table.

This means that although strong eBooking capabilities are widespread, in its present state, eBookings have vastly underdeveloped real-time pricing, leading to huge amounts of money just left on the table for carriers.

This brings us to the future.

The Future: Real-time connections that capitalize on existing infrastructure to boost revenue

Airlines have a massive opportunity to optimize their pricing and increase their utilization and yield taking better advantage of the new digital infrastructure they have put in place. The data for real-time pricing already exists, a prime example being the Freightos Air Index (FAX) on WebCargo Terminal.

Covering more than sixty major airports and dozens of tradelanes, FAX provides the industry with daily indices, historical rate data, weekly analyst reports, news items, and much more. All FAX data is sourced from actual booked rates, backed up by real offered digital rates on WebCargo by Freightos. By tapping this data, users can remain competitive and ensure they are both offering and paying the most effective prices.

[optin-monster slug=”loafdju7ca5hzcmdpitl” followrules=”true”]

Put simply: Carriers who already digitized quoting and booking are now able to automate pricing based on real-time market conditions, and based on specific customers and load configurations, with the potential to increase revenue and maximize load factors.

Many carriers have done well to digitize their quoting and booking. They have leveraged this to create efficiencies in their sales process and save call center costs. But that is just scratching the surface. The real business benefit will come as carriers introduce dynamic pricing to maximize their revenue in a market that is changing quickly.