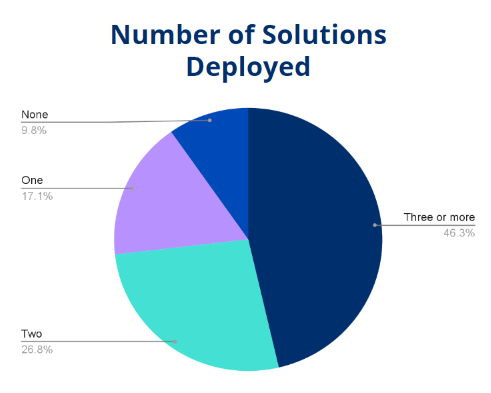

The adoption of technology solutions among freight forwarders is accelerating, transforming how they operate and manage their processes. A recent survey conducted WebCargo by Freightos, which included forty freight forwarders of varying sizes from large enterprises to small and medium-sized businesses (SMBs), revealed – unsurprisingly – that nearly all participants are utilizing tech solutions, with many employing multiple solutions ranging fro TMSs and booking platforms to CRMs and more.

Over the past decade, more than 60% of these forwarders have significantly increased their investment in technology.

Despite these advancements, many technology solutions remain siloed, and the reliance on legacy tools like Excel and manual processes persists. This partial integration may be contributing to the lukewarm satisfaction levels with freight technology, which could explain why a significant portion of forwarders (60%) have switched between different providers for their existing tech solutions in recent years.

Widespread Adoption

The survey evaluated use of a number of popular tech solutions, including TMSs, CRMs, Rate Management solutions, market intelligence platforms, sales portals and eBooking platforms.

These tools tend to be more impactful when used in collaboration, explaining why over 2/3rds are utilizing more than one, and about half employ three or more. The most popular tools among these forwarders include Transportation Management Systems (TMS), Customer Relationship Management (CRM) systems, and eBooking platforms, which was expanded for the purpose of this survey to also include carrier bookings sites.

The eBooking Surge

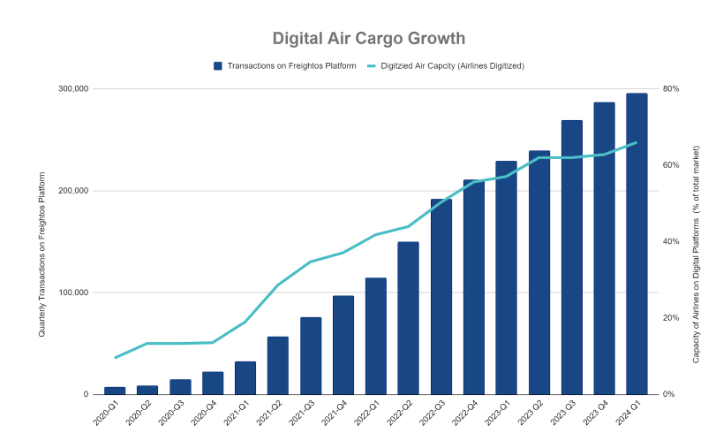

eBooking platforms, particularly for air cargo, have seen a surge in adoption, spurred by the pandemic, which pushed carriers to make their capacity available online and encouraged forwarders to embrace digital rate searches and eBooking.

While carriers representing only 10% of global capacity made their capacity and rates available for eBookings at the end of 2019, nearly 70% of global capacity is now bookable on third-party platforms. And forwarders proved ready for the shift to air cargo as well: as the number of digitized carriers grew, transactions like eBookings on the Freightos Group platform surged too, surpassing one million annually in 2023.

Legacy Tools & Poor Integration – Still a Challenge

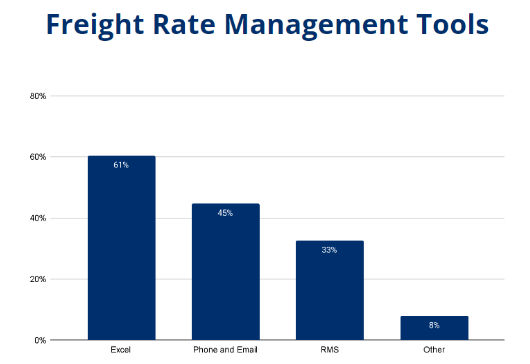

However, even with widespread tech usage, only about a third of forwarders use a Rate Management System (RMS). A significant majority (61%) still rely on Excel, and many use phone and email (45%) to manage their freight rates as well. Additionally, even among forwarders with a TMS, only 51% of their tech solutions are TMS-integrated, indicating that – even for the half of forwarders who do have a TMS – forwarders are often using multiple, siloed solutions.

Overall satisfaction with technology solutions remains moderate, with only 42% of forwarders reporting that they are somewhat or highly satisfied with their digital tools. This dissatisfaction and lack of integration likely contribute to the high rate of switching solutions, with more than 60% of forwarders with an RMS or TMS reporting they have changed solutions within the past five years. Of course, every one of these migrations takes time and budget, demanding non-stop investment.

Looking Ahead: The Future of Tech in Forwarding

In just the last few years, forwarders have made significant progress in the adoption of digital solutions. The increasing investment in technology and the shift towards digital solutions indicates a promising trend, despite the challenges of integration and legacy systems. As integrations become even more widespread, driven by improved carrier API access, more widespread integrations and platformification, and changing customer expectations, this is likely to only increase. The silver lining, perhaps, is that the cost of development may decrease, drive in part by AI solutions.

However, it’s clear that it’s still early days, not least because such a significant portion of forwarders – likely smaller ones – still lack the digital tools required to operate at scale in today’s market.The industry, especially small and medium size players, still has a long way to go to realize the benefits and efficiencies that digital solutions already offer for forwarding operations. The continued evolution of these technologies and more progress in their adoption are essential for further advancements and greater efficiency in the industry.