4 Indian Air Cargo & Freight Industry Trends Defining Digital Transformation

Want a quick overview? Read ahead to find out…

- What the four most explosive trends in the Indian air cargo industry are

- What’s really behind India’s surge in eBookings

- How digital platforms revolutionize cargo flow for specialized goods

- What the future of eBookings in India looks like

4 Indian Air Cargo & Freight Industry Trends Defining Digital Transformation

We all know that shippers (both importers and exporters) need business intelligence at their fingertips. Transit time, routing, and freight cost are all important factors in the total cost of ownership and supply chain planning. Freightos data from the start of 2020 to the end of 2023 reveals four explosive trends in the Indian air cargo industry that have positioned India as one of the world’s largest exporting hubs:

- # of eBookings by end of Q4 2023 has grown by 6168%

- # of airlines participating has grown by 1100%

- # of active IATAs has grown by 2356%

- # of active users has grown by 2608%

Air cargo is going digital. And in a big way.

These trends represent a staggering milestone in the adoption of digitalization from both freight forwarders and airlines in this region of the world. The freight industry’s transformation has been hindered by complexity, misalignment and siloed data across multiple stakeholders, as well as a healthy mix of some cultural reluctance. With a 6168% growth in eBookings alone, it’s safe to say that the latter’s gone. Both freight forwarders and airlines have recognised that transparency, accuracy and readiness of freight data are the most efficient way to enable freight forwarders and shippers to make informed decisions, bringing a 3-8% reduction in underlying freight costs.

What’s Really Behind India’s Explosive eBookings Growth?

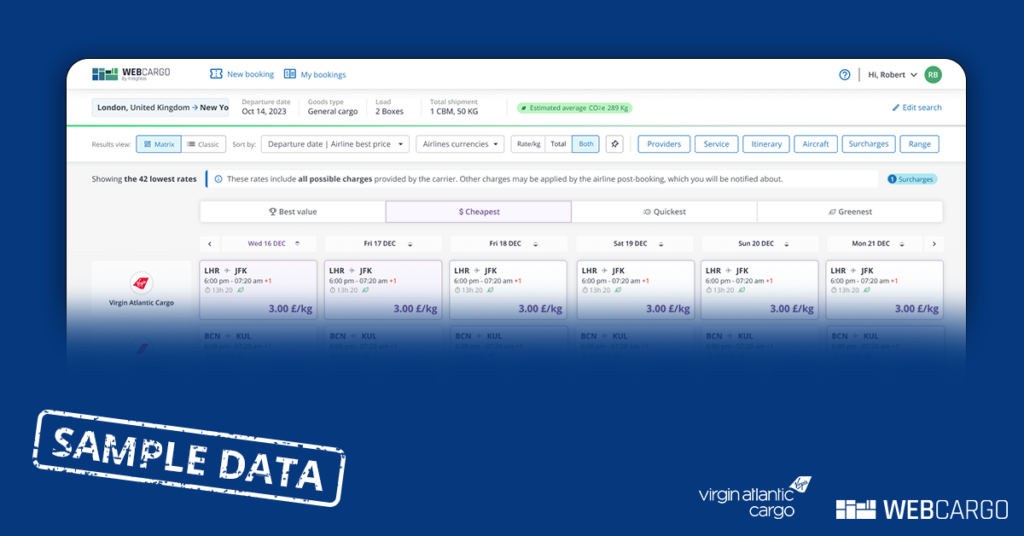

Neutral, third-party booking platforms have rapidly emerged as the star player in India’s Digital Air Cargo transformation. Given that carriers representing some 65% of global air cargo capacity have now gone online via platforms like WebCargo, both carriers and freight forwarders in India have sought to join the trend in unlocking the exponential growth and operations efficiencies such platforms provide. Carriers and forwarders are reaping the rewards of discovering and comparing options from leading global carriers – not just for one lane, but for any lane worldwide.

Driven by the Indian government’s “Make in India” initiative and the larger trend of diversification and expansion of sourcing partners in the global supply chain, India has become one of the largest exporting hubs in the world, as well as the 2nd largest internet market in the world. This has also provided a wealth of opportunities for the Indian Digital Air Cargo market to thrive, with customer demands for the transparency that eBookings provides soaring, as the Indian eCommerce market does.

Both airlines and forwarders have realized that traditional ways of booking and manual processes are no longer scalable.

To service shippers more effectively and efficiently, freight forwarders have embraced Digital Air Cargo to search, book, pay and confirm bookings within seconds instead of days or weeks.

Airlines have therefore rushed to provide online access to real-time carrier schedules, prices, and capacity, providing immediate visibility to lanes and services forwarders may otherwise not have been aware of, enabling them to make quicker, more informed pricing and booking decisions.

This explains the hypergrowth of both carrier and forwarder digitization in a market that was traditionally offline, as both carriers and forwarders are looking to stay competitive in India’s crowded Digital Air Cargo market.

“It’s estimated that over millions of freight forwarding and custom brokers of all sizes in India are servicing domestic and international trades. It’s a fairly fragmented, complicated yet competitive landscape where technology can be at its best,” explains Joyce Tai, EVP World Partnerships at WebCargo.

This complicated yet competitive landscape is where the technology provided by third-party platforms like WebCargo thrives – enabling the seamless unification of data, document and communication standards to optimize operational processes and efficiencies.

Digital Platforms Revolutionize Cargo Flow for Pharmaceuticals, High-Tech, Fresh Produce, and more

There is currently a clear disconnect [link to Joyce DAC] in India between supply and demand supporting various commodities that are critical to the region. The following four key sectors bear the brunt of this disconnect:

- Pharmaceuticals. Freightos data indicates that the enablement of pharma commodities eBookings has been very limited, while freight forwarders in Hyderabad and Bangalore have strong demand for it.

- High-value commodities. These include gems, jewelry, and rough diamonds from Surat and Mumbai, which are significant, but the enablement of eBooking for ease of shipment is currently still suboptimal.

- Temperature controlled commodities. Although promising strides have been made in the shipping of temperature controlled goods (194% YoY growth in 2023 on WebCargo alone!), global rollout is still at an early phase, since the majority of airlines still only support general cargo.

- Fresh produce. This is a ULD shipment and some platforms like WebCargo support ULD, however there is nonetheless a growing need for more carriers to support ULD ebookings.

Seize the Gaps, Seize Growth.

Thanks to India’s digital revolution, carriers and forwarders are turning to digital platforms like WebCargo at breakneck speed, due to the expanded transaction types they make available for digital booking. WebCargo has recognised the necessity to cater for a broader range of products – from standard container shipments or full ULDs to specialized products like hazardous materials or temperature controlled commodities – and is ongoingly working with carriers to facilitate expansion of these crucial services.

Dominate Locally, Win Globally: The Case Against Pan-India

Although the “Pan-India” approach may be very common among companies based in the West, the hypergrowth in eBookings in India at WebCargo can likely be put down to an entirely opposite approach.

Customers crave the ability to search, compare and book efficiently. India is no different.

BUT air freight in India is a complicated and competitive landscape, which means you need the right people in the right place, in order to support business in India.

WebCargo’s recipe for success?

- Ditching the ‘Pan-India’ approach. WebCargo began in the India South region and then expanded into Mumbai (India-West) and Delhi (India North and East).

- Placing local representatives. These onboard and support each airline station, as well as the freight forwarder branches region by region.

- Understanding your market. India has a significantly higher contact-to-order ratio, which means local support is required (remember those local representatives?). WebCargo’s Chennai office serves as the hub of support. India’s air freight is also very ad-hoc – freight forwarders typically request rates for the same shipments across a dozen airlines. Part of knowing the market is realizing that airlines need to encourage and enforce eBookings as well, to prevent it from acting merely as a pricing reference with a limited impact.

- Go (or fly) the extra mile. Airport maps, flight schedules and much more were also introduced to the market. In today’s data-driven world, the ability to pair data and insights with actual interactions is a true differentiator.

This approach has led to unprecedented success in the adoption and implementation of eBookings – a 6168% growth in eBookings, to be precise.

Navigating Tomorrow: What’s Next for eBookings in India?

Shippers and forwarders are clamoring for eBooking, but some airlines are still lagging behind. Now is the time for more Indian airlines to step up and empower communities with seamless eBookings. Clarity of market demand, pricing, and market supply through digitization of air cargo can all be used to inform decisions – and not just for freight forwarders. Airlines can vastly improve pricing or capacity availability with real-time access to changing search trends from forwarders. Digitalizing airlines can revolutionize port-to-port transportation, fulfilling shippers’ needs from pickup to delivery, customs, insurance, and multimodal transport.

On that front, WebCargo by Freightos is already locked, loaded and ready to shape the future of freight with its full stack of technologies from rate, quotation, data, and shipment management to eBookings, all built on top of Freightos’ OpenFreight data standard. This colossal tech stack works alongside the ERP, TMS, CRMs and eDocument (eAWB) systems preferred by freight forwarders, allowing them (as well as airlines) to enhance both the online and offline components of the industry and effortlessly drive value.