Global Freight’s Peak Season

Judah Levine, Freightos’ Head of Research, welcomes Robert Khachatryan, CEO of Freight Right Global Logistics, for insights and projections on what the latest air cargo trends might indicate for the rest of 2023. Much of the global freight data cited is available.

Air Cargo Insights for Peak Season

The air cargo industry is a dynamic arena that constantly adapts to shifting demand, emerging trends, and unforeseen challenges. As we step into the end of Q3, at potentially the global freight peak season, the sector finds itself at a crossroads, shaped by a mix of recovery and transformation.

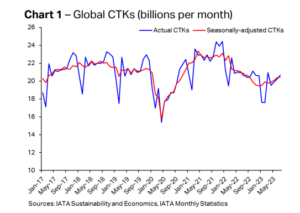

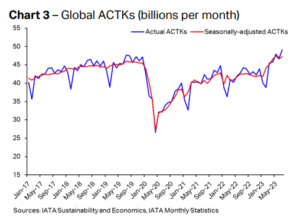

The latest IATA data from July show that global air cargo volumes have been recovering gradually since the start of the year. While there has been gradual improvement, air cargo volumes remain below the pre-pandemic levels of 2019, as general demand lags and ocean logistics have returned to normal.

Air Cargo Demand Air Cargo Capacity Recovering

As the air cargo industry grapples with lower volumes, there has been a capacity growth, mostly from the rebound in passenger travel. This combination has seen air cargo rates, as seen in Freightos Terminal, dipping below the levels seen last year, and despite low demand and increasing capacity, several factors are nonetheless keeping rates above 2019 levels on most lanes.

To unravel the current trends and what this means for global freight peak season, we turn to two industry experts: Judah Levine, Head of Research at Freightos, and Robert Khachatryan, CEO at Freight Right Global Logistics. In a candid interview, they delve into the intricacies of the air cargo landscape, dissecting the factors behind the rise in capacity, the dip in demand, and the curious persistence of elevated rates.

Trends and Predictions with Robert Khachatryan

Judah Levine, Head of Research at Freightos: Rates are approaching normal range, but they do remain higher than pre-pandemic. So what are some of the factors that are playing into the increase in capacity, decreases in demand, and rates coming well down from where they were, but still relatively to historical levels they remain kind of high? Certainly increased fuel cost is one factor, but what else is going on that we have elevated rates when the market is for the most part down?

Robert Khachatryan, CEO at Freight Right Global Logistics: Yeah, it’s definitely been an interesting year of consistently high rates. They’re not high, they are just elevated from historical norms. What we would see historically, pre-pandemic, is a lot more volatility that what we are seeing this year. There was a lot of seasonality to it – when a new iPhone launched you would see capacity rates shoot up or pre-holiday seasonality driving rates. Rates throughout the years were dropping from the 2 dollar range and then on the high side being in the 6-7 dollar range. This year, there is a consistent range between 4-5.50 USD and not a lot of volatility. I think that’s a factor of somewhat subdued demand and not a lot of peaks and valleys because of that.

Other factors involve airspace being closed for carriers on European routes. On the Transpacific lanes you have a significant reduction in capacity over the last year because of sanctioned airlines. So while the passenger aircraft capacity has steadily increased, at the same time you have cargo capacity being decreased by some of the carriers not being able to fly in and out of the United States.

And by bypassing Russian airspace, in a lot of cases it obviously creates a higher overhead cost for airlines and air carriers are arguably doing a better job of staying profitable and covering their underlying costs compared to ocean carriers. So I’d say there’s better management by airlines of basically staying profitable and not operating below cost.

Judah: Interesting. There’s a lot of factors at play. I think part of it is, as you said, there’s an increase in passenger travel that’s adding capacity to a lot of these markets which is putting downward pressure.

There’s been an interesting increase in the last few weeks to the Transpacific. I think it’s due to the fact that tourism in China has not rebounded as much as expected, so it’s possible it’s not having that kind of downward pressure from there.

And as you said, there’s also different kinds of policy factors and restrictions that might be also impacting the rebound in the number of flights, specifically to the Transpacific compared to the other lanes.

Judah: There have been some reports of some electronics product launches starting soon. In the industry media there’s a lot of back and forth of what the expectations for peak season are in air cargo this year. What does the rest of the year look like, as far as you can tell?

Robert: I think I’m more optimistic about air freight than ocean honestly.

We are seeing an uptake in volumes for existing customers. We’ve seen that in August and we continue to see that in September. So there seems to be a little bit stronger demand for air freight.

And that’s probably driving some of this rate increase, although with the renewal of COVID we have to see if this will have any effect or if any governments go to extremes of implementing any kind of restrictions that may affect cargo capacity.

But I think there is an underlying increase in demand driving at least the Transpacific rate increases. It will probably stabilize sometime in October, either stay flat or drop towards the end of the year.

Peak Season Outlook

Judah: Oh really? So it’s a little bit early for air freight peak season. In terms of increase in the bookings you’ve seen so far, is there any particular vertical you are seeing more active than others?

Robert: Yeah, definitely following the general rule of thumb (anything that’s expensive or small) typically tends to do well with airfreight. You know, whether that be electronics or luxury goods. We are seeing some very niche verticals such as smaller sporting goods, like golfing equipment. People are still spending those and there still seems to be a good demand for that.

Perhaps we’ll see another optic as we get closer to the holiday shopping season. We’re seeing a lot fewer products in all the other verticals that we’ve seen the last couple years by air freight. It’s definitely normalizing more towards things that make sense to be flown.

Judah: Right, no hot tubs or exercise bikes being moved by air freight anymore!

Robert: Or chickens! We saw some oddities before.

Judah: Those days are behind us now! Robert, thank you so much for sharing your time and insights with us.

Robert: Thank you Judah, always a pleasure.