The Changing Face of International Freight Rate Management in 2023 | Part I

In this article, you’ll discover:

- The #1 rate management and pricing problem carriers and forwarders face

- A revolutionary logistics fix: The surprising solution the cargo industry adopted for superior rate management

- The three industry trends you can’t afford to miss, and why

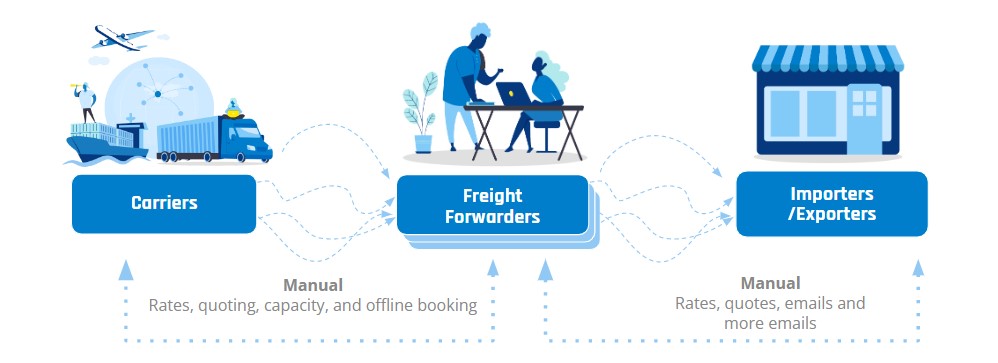

Global freight involves a complicated and expansive ecosystem with many mission-critical parts to it. Over the last decade, carriers, freight forwarders, importers and exporters, have been looking to increase the efficiency of information-transfer between them and the freight forwarders in the middle, to issue quotes as quickly and accurately as possible. Although pricing, quoting and booking is just a small part of the process in the freight ecosystem, even minor delays can wreak havoc on the entire supply chain efficiency, making a seamless pricing solution a top priority.

The Pricing Problem

- When booking freight shipments, especially on the spot market, forwarders have to spend expensive time manually getting rates via calls and emails to compile quotes and understand available capacity at the time of shipping. This is then further aggravated by optimizing routing, pricing and calculating surcharges and fees. Contracts help but ultimately pass that problem downstream to their customers, with 70% of BCOs depending on spreadsheets for calculating pricing. Currently, 45% of procurement professionals take 2+ business days to price/book shipments, and by the time the quote is reviewed by the customer for offline booking, pricing and capacity may have changed.

- For importers and exporters with spot shipments, the process of getting rates and capacity from a freight forwarder via email or phone calls can stretch on, especially when comparing multiple forwarders The high price variance – our annual mystery shopping survey finds LCL spot variances of over 100% – and time-input makes this process inefficient for all three parties.

- Carriers struggle to optimize capacity when bookings and pricings are offline since both change in real-time. In other industries, available space in a concert hall or a passenger airplane will change in real-time based on available seats…but even if bookings are conducted digitally, if pricing is offline, actual capacity can’t be compared. As a result, even prior to the pandemic in 2019, air cargo capacity utilization was under 50%.

The result? Importers and exporters wait and their supply chain suffers, forwarders put in expensive manual labor and carriers don’t optimize capacity utilization. Global trade depends on global freight, but it’s held back by volatile pricing and capacity, poor visibility, and inefficient operational processes.

The Solution: A Better Way to Price and Book

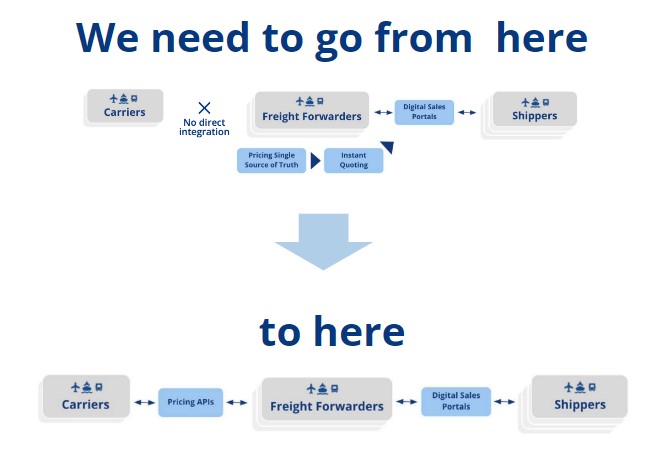

End-to-end air cargo pricing and booking from airlines through forwarders to shippers. By enabling carrier-forwarder-shipper pricing and booking connectivity, forwarders can offer real-time booking capabilities to the end shipper, reducing spend, saving time, and increasing revenue.

The key significance here is that connecting any of the two parties – carriers to forwarders or forwarders to shippers – is far less efficient than connecting all three. Embracing this solution, three notable trends have taken a hold (and rapidly escalated!) over the last two years in the air cargo industry. Here’s what they are, and why forwarders should care…

[optin-monster slug=”naongpfzyf5uzghn5lfa” followrules=”true”]

Staying Ahead of The Logistics Pricing and Booking Curve: 3 explosive industry trends

Trend #1 – Carrier Digitization

Airlines hit the turbulence of the pandemic head-on by going digital, with third party cargo booking platforms experiencing an explosive 300% increase in capacity from 2020 to Q2 2022. The scramble came as flight schedules were disrupted, remote work became the standard, and bellyhold capacity shrunk due to COVID restrictions, throwing supply chains into disarray. As a result, airlines turned to digital tools that could enable carriers to adapt and promptly respond to ever-changing circumstances.

Airlines have enabled instant air cargo rate search and eBooking on third party platforms like WebCargo, making over 50% of global air cargo capacity available online by 2023 – a more than 16x increase since the end of 2018.

The ability to (digitally) compare capacity, prices and routing options across air carriers, and then book capacity on a specific flight at a specific price, gives forwarders and shippers what they’ve been searching for: Supply chain control.

With access to real-time carrier schedules, prices, capacity, and immediate visibility to rare lanes and services, forwarders gain the mission critical information required to make faster, more informed pricing and booking decisions.

[optin-monster slug=”mfilmzwn5p4ntbhlvngk” followrules=”true”]

Trend #2 – Sky-Rocketing Shipper Expectations

As shippers increasingly expect the ease of the B2C experience in B2B settings, so the impact of air cargo digitization on the customer experience is paramount. The 24/7 (even mobile) convenience of fast, reliable, low touch eBooking, with bookable rates based on actual capacity for specific flights, and instant confirmation, is pulling the air cargo experience up to the standards that customers demand.

…and as shippers are looking to make faster, more informed decisions, forwarders are leaning towards more sophisticated tools to meet these more sophisticated expectations.

Increasingly volatile global freight demands mean a more competitive environment when vying for business. Providing more optionality to shippers for increased visibility, speed, and efficiency of freight quoting and booking has therefore become a necessity for forwarders looking to gain an edge in customer acquisition and retention.

Trend #3 – Integration, Integration, Integration

With the adoption of digital tools, carriers gain proper visibility into available capacity, and can instantly give out pricing for that capacity, which freight forwarders then capture to build quotes for the importers and the exporters.

Third-party platforms like WebCargo, are therefore creating those lines of integration between the different parties so that this process can happen in the fastest, most optimized and efficient way via APIs.

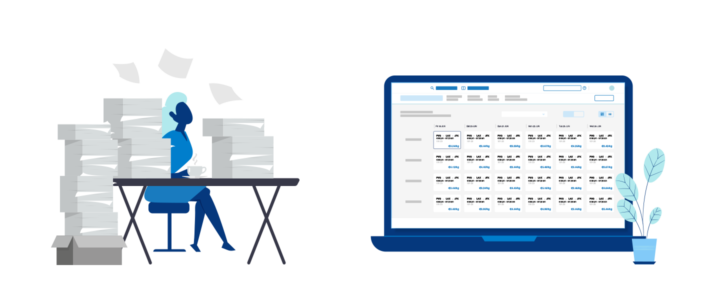

Ultimately, forwarders will be able to access and manage all carrier rates entirely via API connectivity, but in 2023, forwarders still need rate management tools. They still need the ability to bring contract rates together with fees and their margins, all within their operational systems to build quotes.

As a result, 2023 is a hybrid era where forwarders must use rate management systems to take advantage of the digitized world carriers have presented, via APIs that are available for instant spot quoting, alongside clear capacity and pricing with dynamic quoting.

What Does All This Mean for Freight Forwarders?

Forwarders simultaneously interact with numerous different parties in the logistics chain – such as customers, shippers, managers, transporters, etc. When the processes aren’t organized well, operational efficiency often takes the hit.

Delivering this direct flow of information between all parties ultimately drives a forwarder’s operational efficiency and provides a better customer experience. Once digitalization occurs at the source – the carriers – forwarders can then use rate management systems and quoting tools to quickly access and manage the pricing, capacity, routing and timing, all of which can then be made available to shippers.

This means that digitalization of rate management, quoting and booking provides a crucial puzzle piece for maximizing operational efficiency and customer satisfaction across the entire logistics chain.

Hungry for more? Stay tuned for Part II of this article for information on:

- Why rate management, quoting, and sales tools must adapt to thrive

- The essential features for powerful RFPs